How to Budget for Living in Riverdale: A Comprehensive Guide

Living in Riverdale, Georgia, offers the perfect blend of affordability and convenience, but managing your finances effectively is key to fully enjoying everything the city has to offer. Whether you’re a first-time homebuyer, a growing family, or a retiree, creating a comprehensive budget is the first step toward financial confidence.

This guide walks you through the key expenses to consider when living in Riverdale and offers practical tips to help you build a budget that aligns with your goals. For a deeper understanding of local costs, check out our cornerstone article, What’s the True Cost of Living in Riverdale.

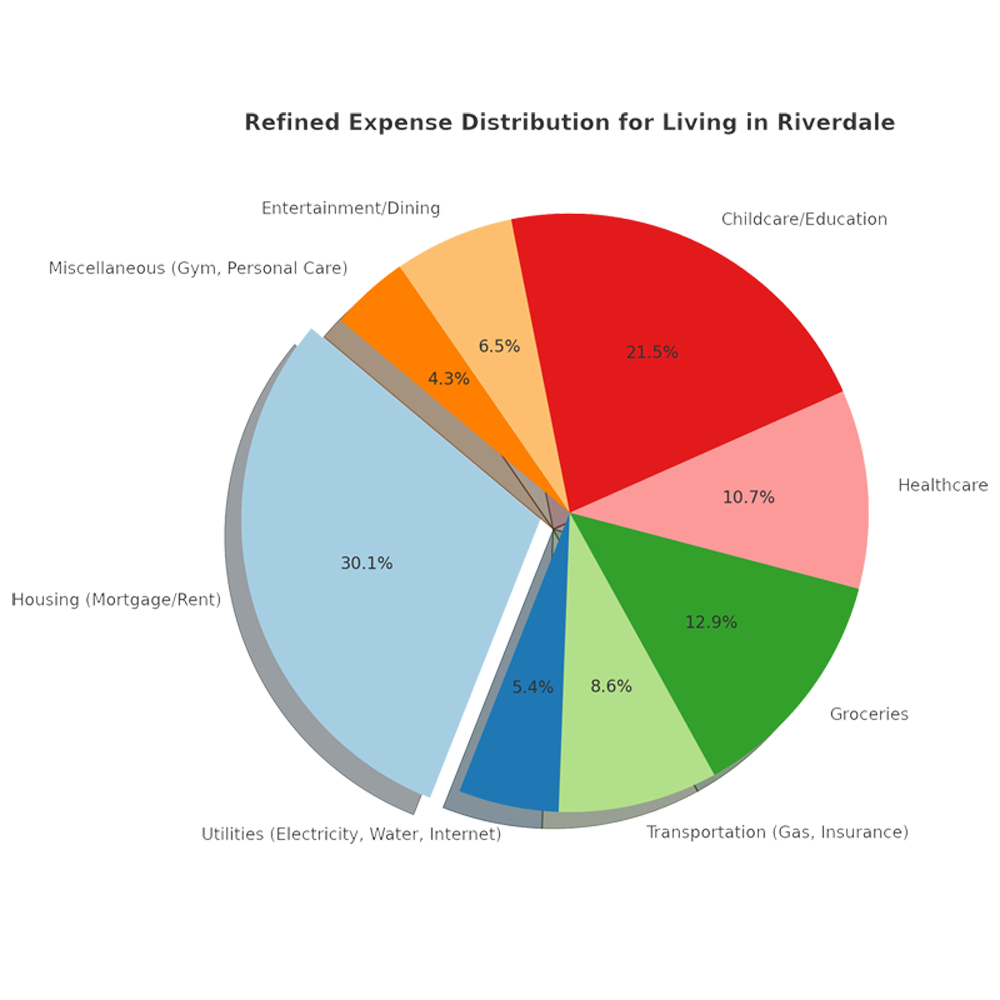

- Housing: The Largest Expense

Buying a Home in Riverdale

- Median Home Price: As of 2024, the median price for a home in Riverdale is approximately $275,000.

- Down Payment: Depending on your loan type, you’ll need 3%–20% of the home’s purchase price.

- Monthly Mortgage Payment: Includes principal, interest, property taxes, and insurance.

Renting in Riverdale

- Average Rent:

- 1-bedroom apartment: $1,000–$1,200/month.

- 3-bedroom home: $1,500–$1,800/month.

Pro Tip:

Factor in additional costs like HOA fees if you’re purchasing a home in a community with amenities.

- Utilities: Keeping the Lights On

The cost of utilities in Riverdale is generally affordable, but it’s important to include them in your budget.

Average Monthly Utility Costs:

- Electricity (Georgia Power): $100–$150.

- Water and Sewer (Clayton County Water Authority): $30–$60.

- Internet and Cable (AT&T, Xfinity, or Spectrum): $60–$120.

- Trash and Recycling: $15–$30.

Energy-Saving Tips:

- Invest in energy-efficient appliances to reduce electricity usage.

- Use programmable thermostats to regulate heating and cooling.

- Transportation: Getting Around Riverdale

Driving Costs

- Gas Prices: Typically lower than the national average, around $3.20/gallon.

- Insurance: Expect to pay $1,200–$1,800 annually for auto insurance, depending on coverage.

- Maintenance: Routine expenses like oil changes and tire rotations average $500–$700/year.

Public Transportation

- MARTA: Riverdale is serviced by MARTA buses, with fares as low as $2.50 per ride.

- Groceries: Feeding Your Family

Average Monthly Grocery Costs

- Individuals: $250–$400.

- Families: $600–$1,000.

Riverdale residents have access to several grocery options:

- Aldi: Known for low prices on staples.

- Kroger and Publix: Offer a balance of affordability and variety.

- Farmers Markets: Shop locally for fresh produce and support the community.

- Healthcare: Prioritizing Wellness

Healthcare is a vital component of any budget, especially for families and retirees.

Average Costs:

- Health Insurance Premiums: $450–$750/month for an individual plan.

- Out-of-Pocket Costs: Budget for co-pays, prescriptions, and dental care, averaging $1,500–$3,000 annually.

Riverdale is close to several reputable healthcare facilities, including Southern Regional Medical Center and nearby clinics.

- Childcare and Education

For families, childcare and education are significant budget considerations.

Childcare Costs:

- Daycare: $800–$1,200/month per child.

- After-School Programs: $100–$300/month.

Education Costs:

- Public Schools: Free for residents.

- Private Schools: Tuition ranges from $6,000–$12,000/year.

- Entertainment and Dining

Recreation Costs:

Riverdale offers plenty of free or low-cost entertainment options:

- Parks: Enjoy Riverdale Regional Park or Flat Shoals Park.

- Community Events: Seasonal festivals and outdoor movie nights.

Dining Out:

- Average cost for a meal at a casual restaurant: $12–$20 per person.

- Family dinner at a sit-down restaurant: $50–$80.

- Miscellaneous Expenses

Personal Care and Fitness

- Gym Membership: $25–$60/month.

- Haircuts: $15–$40.

Pet Care

- Food and Supplies: $30–$50/month.

- Vet Visits: $100–$300 annually.

Emergency Fund

Set aside 3–6 months’ worth of living expenses to prepare for unexpected costs.

- Tips for Budgeting Successfully

Track Your Spending

Use apps like Mint or YNAB to monitor your expenses and adjust as needed.

Set Goals

Define short-term and long-term financial goals, such as saving for a home or paying off debt.

Automate Savings

Set up automatic transfers to a savings account to ensure consistent contributions.

Frequently Asked Questions

Q1: Is living in Riverdale affordable?

Yes! Compared to neighboring cities like Atlanta, Riverdale offers lower housing costs and overall living expenses.

Q2: How can I save money on utilities?

Invest in energy-efficient appliances and take advantage of rebates offered by providers like Georgia Power.

Q3: Are there programs to help with housing costs?

Yes, first-time homebuyers can explore options like Georgia’s Dream Homeownership Program.

- Resources for Riverdale Residents

- Clayton County Water Authority: Manage your water and sewer bills.

- MARTA: Plan your public transportation routes.

- Riverdale City Hall: Stay updated on community programs and events.

Conclusion

Budgeting for life in Riverdale starts with understanding your expenses and planning accordingly. From housing and transportation to entertainment and healthcare, this guide provides the tools you need to create a budget that works for you.

For a more in-depth look at Riverdale’s cost of living, visit our cornerstone article, What’s the True Cost of Living in Riverdale. Together, let’s make your financial goals a reality while enjoying all that Riverdale has to offer.

Disclaimer: The provided data is for general informational purposes and may not reflect the most current statistics.

Need help finding an affordable home or navigating Riverdale’s housing market? Contact Johnnie Benton at (470) 885-8804 or jebentonsr@gmail.com, and let’s create a plan that fits your budget!

Categories

Recent Posts

GET MORE INFORMATION